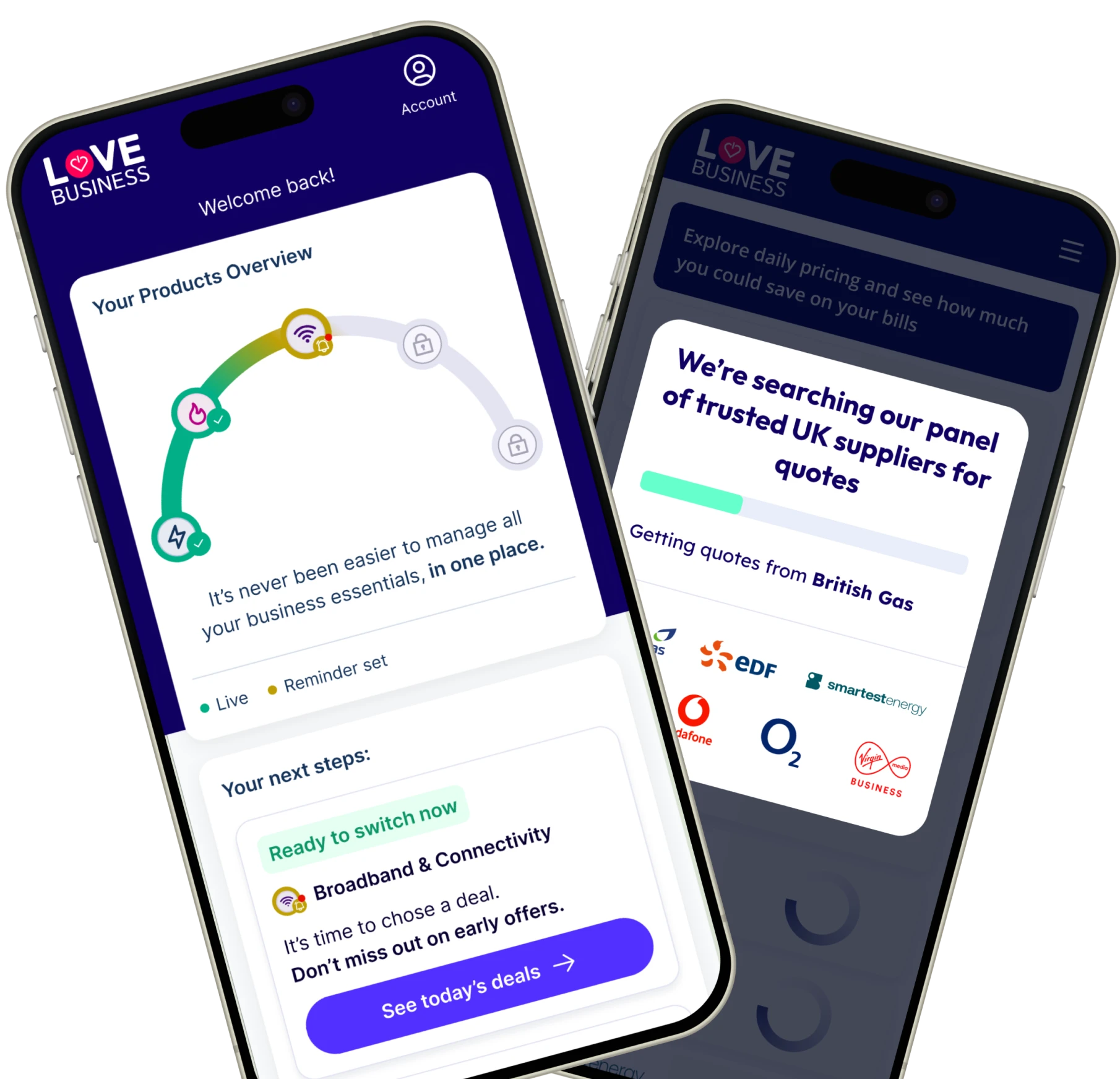

Tired of high rates on your card machine?

Switch Card Payment Machines

Simple, secure payment solutions for businesses of all sizes. From card machines to contactless and mobile payments, we’ll help you take payments with ease.

Compare Payment Solutions